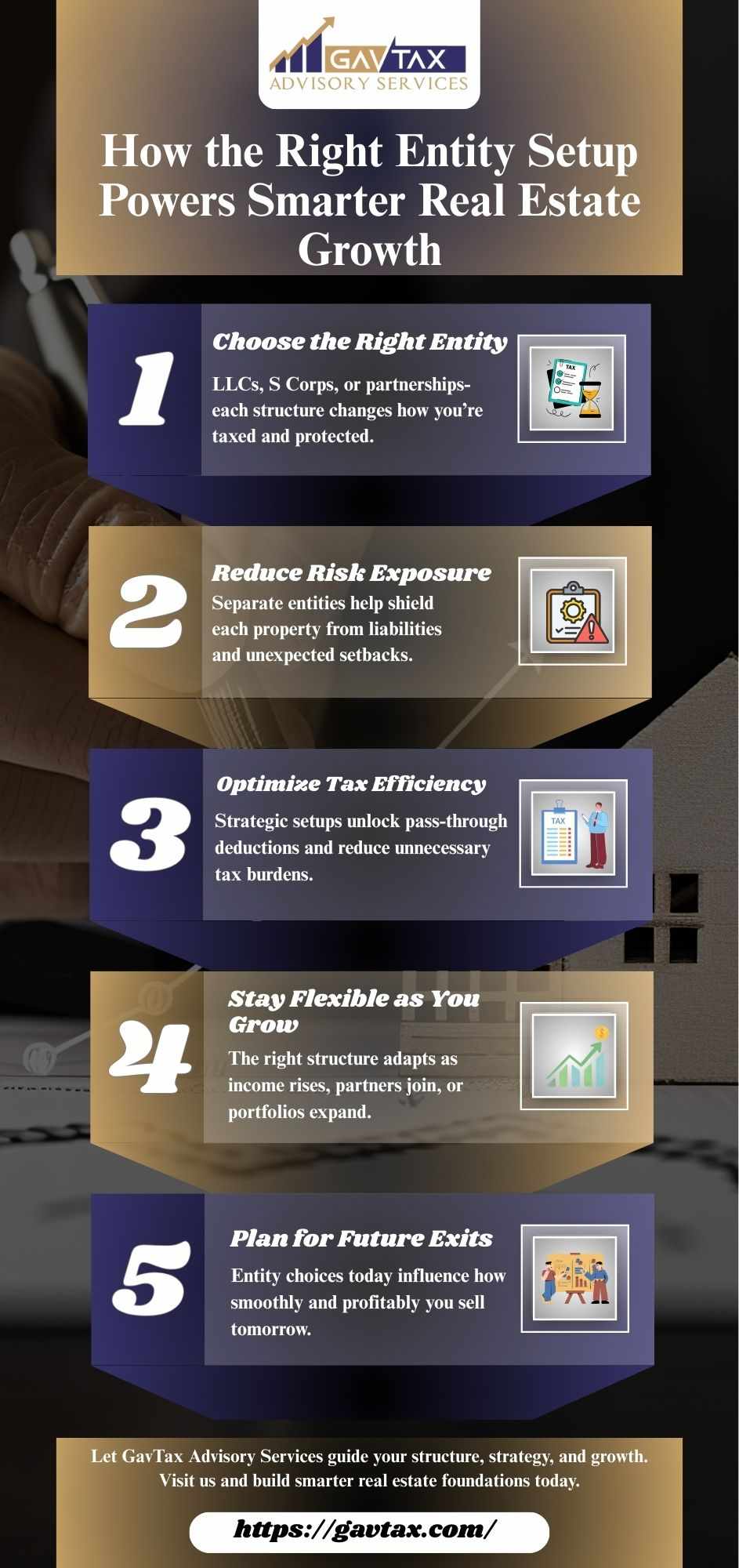

Scaling property portfolios works best with guidance from a real estate CPA. At Gavtax Advisory Services, smart structure meets long-term protection. The right setup today shapes profits, taxes, and exits tomorrow. Here are some points to look at:

1. Choose the Right Entity

LLCs, S Corps, or partnerships-each structure changes how you’re taxed and protected.

2. Reduce Risk Exposure

Separate entities help shield each property from liabilities and unexpected setbacks.

3. Optimize Tax Efficiency

Strategic setups unlock pass-through deductions and reduce unnecessary tax burdens.

4. Stay Flexible as You Grow

The right structure adapts as income rises, partners join, or portfolios expand.

5. Plan for Future Exits

Entity choices today influence how smoothly and profitably you sell tomorrow.

Wrap Up:

Let GavTax Advisory Services guide your structure, strategy, and growth. Visit us and build smarter real estate foundations today.

Write a comment ...