Description

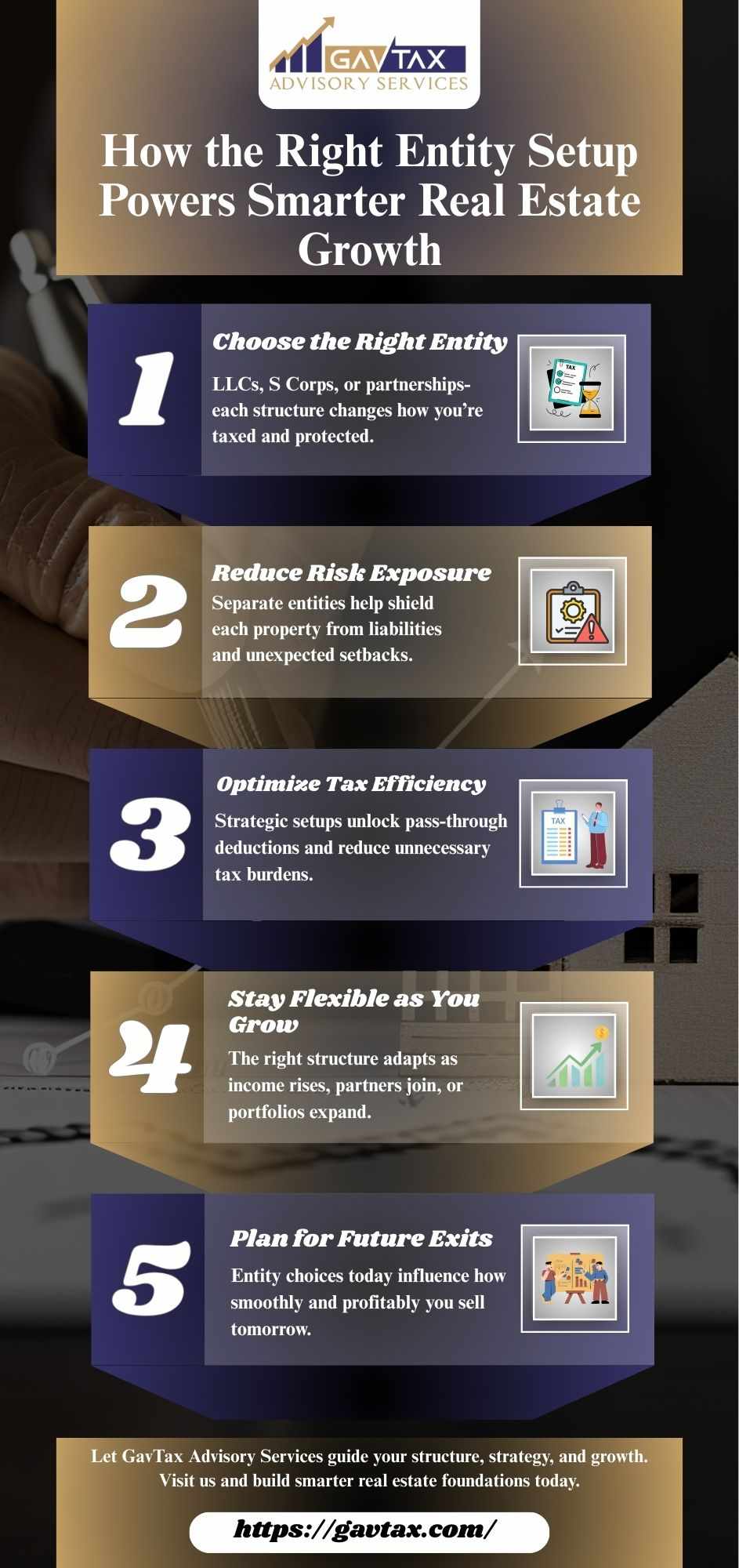

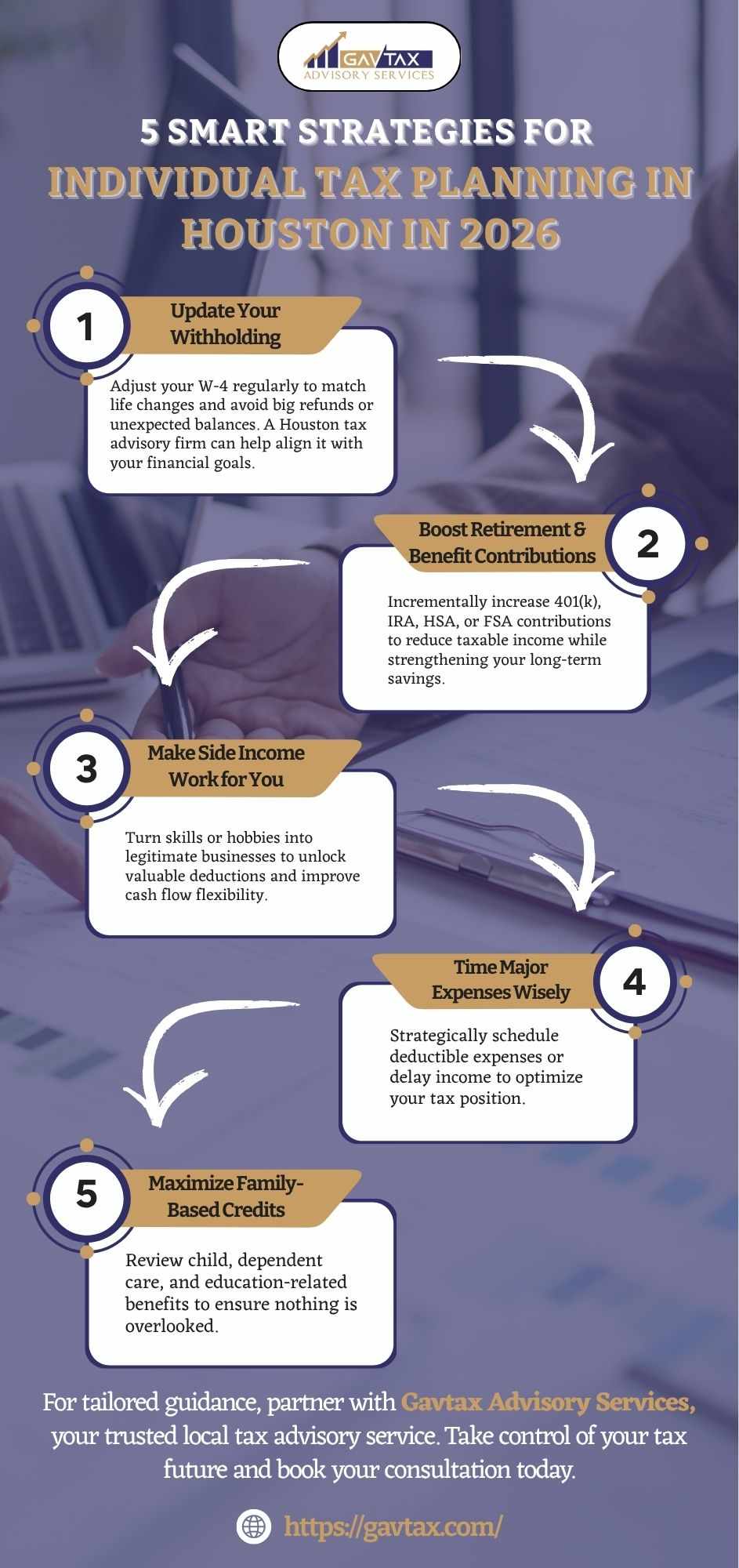

Maximize Deductions • Protect Your Profits • Grow Your Portfolio

Strategic tax planning helps real estate investors cut liabilities, boost cash flow, and protect profits. Our expert guidance ensures every property decision works toward long-term growth.

Strategic timing for 1031 exchanges and capital gains

Advanced depreciation & cost-segregation strategies

Customized plans to reduce tax liability and boost cash flow

Expert guidance tailored to every investment stage

Start planning smarter, schedule your consultation today!

Write a comment ...