Does tax season fill you with dread? You are not alone. Many people feel confused by complex forms and changing rules. The search for a true expert begins when you type "tax preparation services near me" into your browser. You need a guide, not just a form filler.

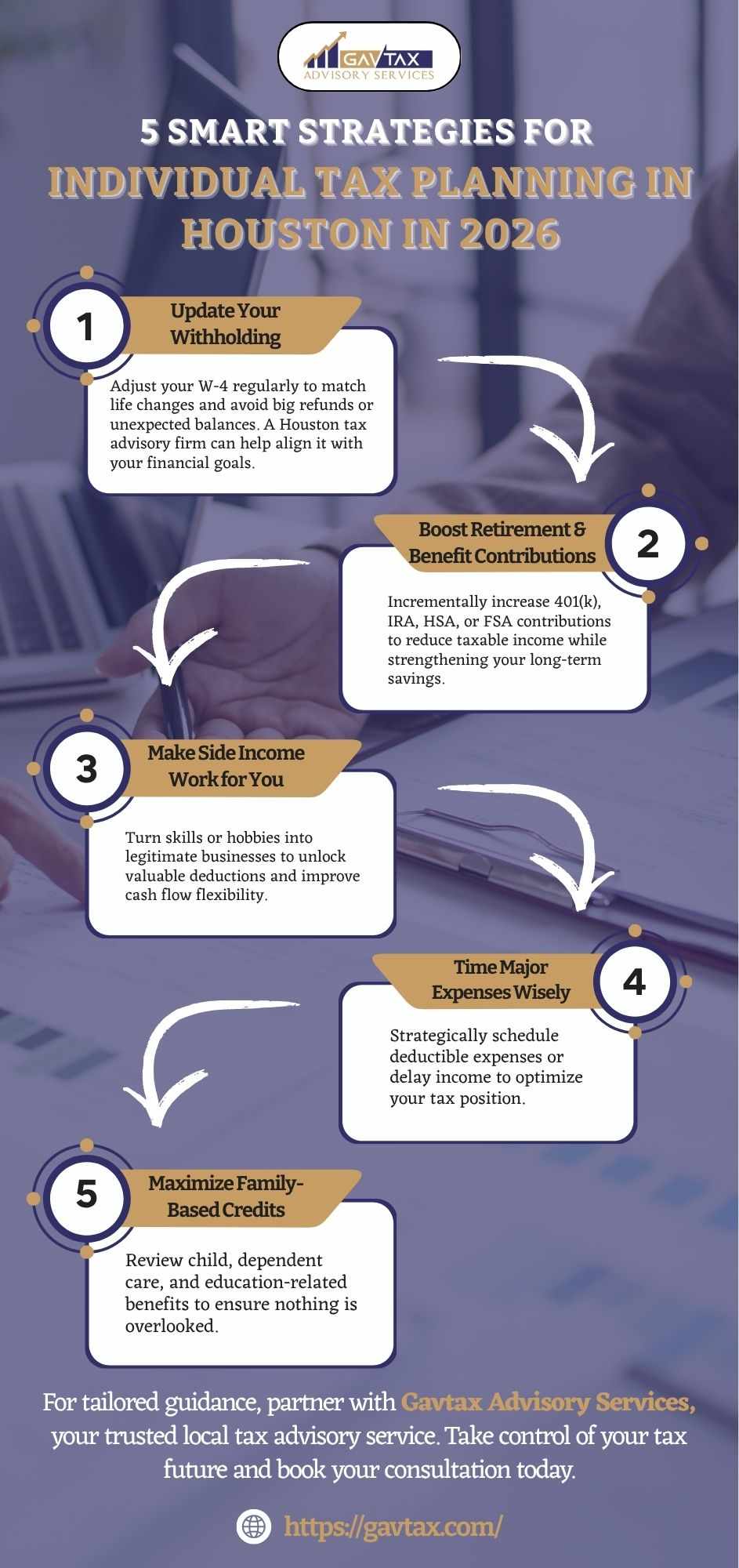

This article helps you understand how to choose a professional who simplifies taxes. We will explore what makes a great tax advisory services in Los Angeles or a dependable Houston tax advisory firm so valuable.

What is Tax Advisory and Why Do You Need It?

A tax advisor provides strategic help all year long. They do not just file your annual return. These experts understand complex tax codes and use that knowledge to protect your money.

You might handle a simple W-2 yourself. But life gets more complicated. A local tax consultant near me becomes essential when you face situations like:

Launching a business or a side gig

Earning income from investments or rental properties

Going through life changes like marriage or retirement

Receiving a letter from the IRS

Signs You Need Professional Tax Help

How can you tell if you should hire a professional? Your daily life often gives you the answer.

· Major Life Events Impact Your Taxes

Significant moments like buying a house, having a child, or retiring change your tax situation. An advisor identifies new credits and deductions you qualify for. They ensure you do not make expensive mistakes during these transitions.

· You Work for Yourself or Own a Business

Self employment and business ownership introduce tax complexity. You need to track expenses, handle estimated payments, and understand self employment tax. A good advisor finds every legitimate deduction for your home office or equipment, which often saves you more than their fee.

· The IRS Sent You a Notice

An IRS letter can cause anxiety. A tax professional knows how to manage these communications. They interpret the notice, develop a response plan, and work with the IRS on your behalf. This service lifts a huge weight off your shoulders.

Key Benefits of Using a Tax Professional

Hiring an expert is an investment that usually pays for itself. The advantages go far beyond a single tax return.

· Keep More of Your Money

Tax advisors know the rules inside and out. They find deductions and credits you might overlook. This thorough approach often uncovers savings that easily cover the cost of their services.

· Reclaim Your Valuable Time

Preparing taxes can eat up your entire weekend. Handing this task to a professional gives you that time back. You can focus on your family, hobbies, or business instead of struggling with complicated paperwork.

· Enjoy Year Round Peace of Mind

Perhaps the biggest benefit is confidence. You gain the assurance that an expert manages your taxes. They help you avoid errors that trigger audits and provide support if the IRS has questions. This partnership means you have a trusted person to call before making big financial moves.

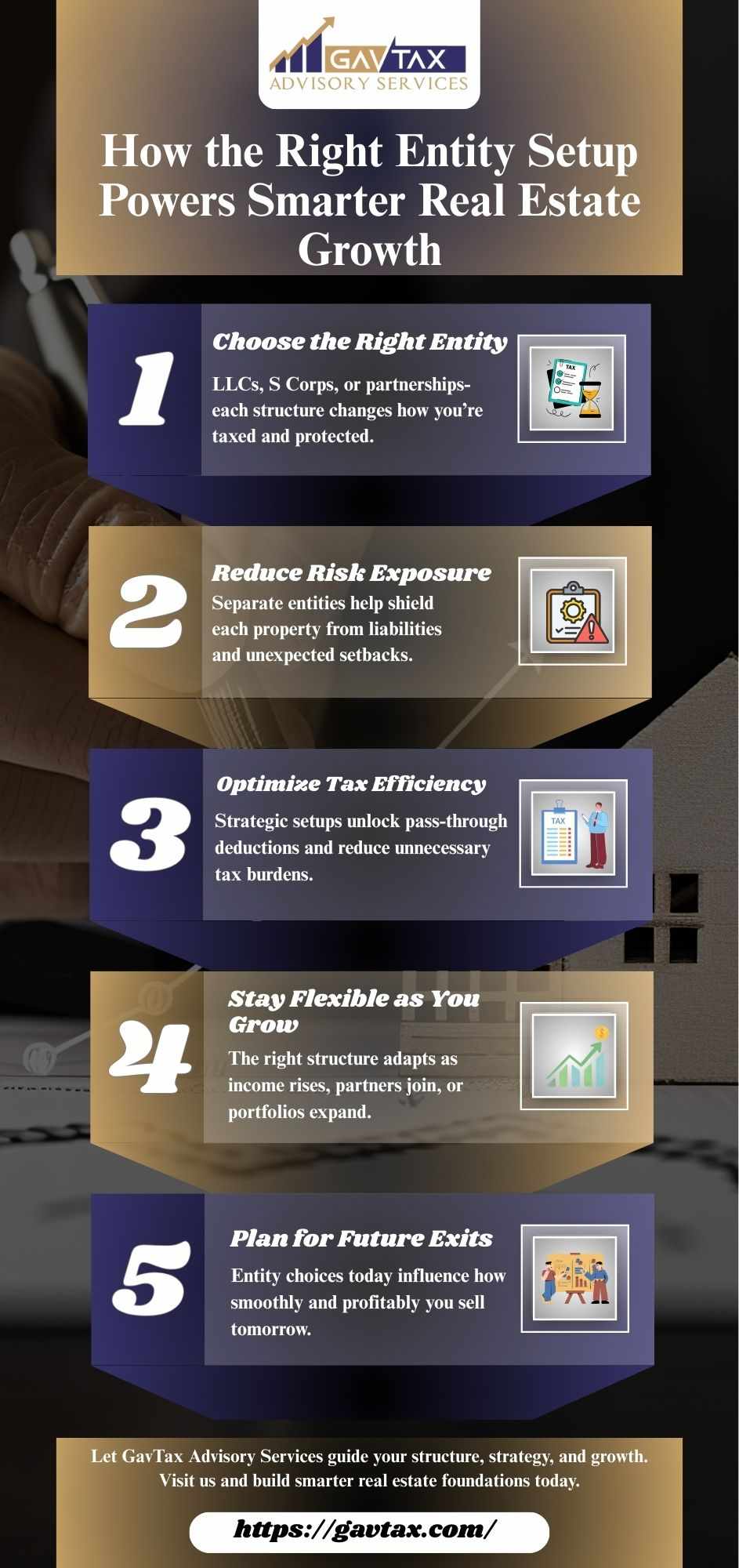

How to Choose Tax Advisory Services in Los Angeles?

Selecting the right firm requires careful thought. Look for these important qualities.

- Verify Their Professional Credentials

Always check for credentials like Enrolled Agent (EA) or Certified Public Accountant (CPA). These designations prove the professional has the knowledge and authority to represent you before the IRS if needed.

- Evaluate Their Relevant Experience

Find an advisor who understands your specific situation. Ask them about their experience with clients like you, whether you run a small business in Houston or manage complex investments in Los Angeles.

- Understand Their Pricing Model

A reputable firm provides clear and transparent pricing. Many offer a free initial analysis to review your needs and give you an upfront price quote before you commit to any work.

- Confirm They Offer Ongoing Support

Your tax obligations continue all year. Choose a firm that provides continuous support and tax planning services. This ensures you make smart financial decisions every month, not just in April.

Finding a Trusted Houston Tax Advisory Firm

Your search for a local expert should focus on trust and compatibility. You are forming a long term partnership for your financial health.

Your Path to Financial Confidence Starts Now

Finding the right tax partner transforms tax season from a stressor into an opportunity. It is about building a relationship with someone who protects your financial well being. The correct advisor delivers clarity and confidence, not just a completed return.

If you want to stop worrying about taxes and start making them work for you, take the next step. The team at GavTax Advisory Services offers the expert guidance we discussed. Contact GavTax for a professional consultation today and move toward a simpler, more secure financial future.

Write a comment ...