There are advantages of owning residential property in Dallas, but the tax time of the year usually comes with unexpected headaches. Life experience demonstrates that even a minor mistake during reporting can become a significant financial drain to both the homeowners and investors. That is why seeking the services of a Residential real estate tax consultant is so important; they identify problems before they get out of hand and assist you to make better decisions about your Real estate Property Taxes.

It is like having a responsible guide who understands the local regulations inside and out, and keeps your finances on steady ground. Let's get inside and explore more about it!

What a Residential Real Estate Tax Consultant Actually Does?

A Residential real estate tax consultant will focus on the home and rental property tax, and you can be sure that the filings are made according to the requirements of both federal and local Dallas-area. They also offer professional advice on the depreciation of rental properties to distribute the costs over time to optimize cash flows and increase your selling or refinancing opportunities in the future. Their practical advice supports your everyday property decisions.

Core Offerings in Residential Property Tax Advisory

A solid Residential property tax advisory service covers the essentials to protect your assets without overwhelming you. Here's what stands out:

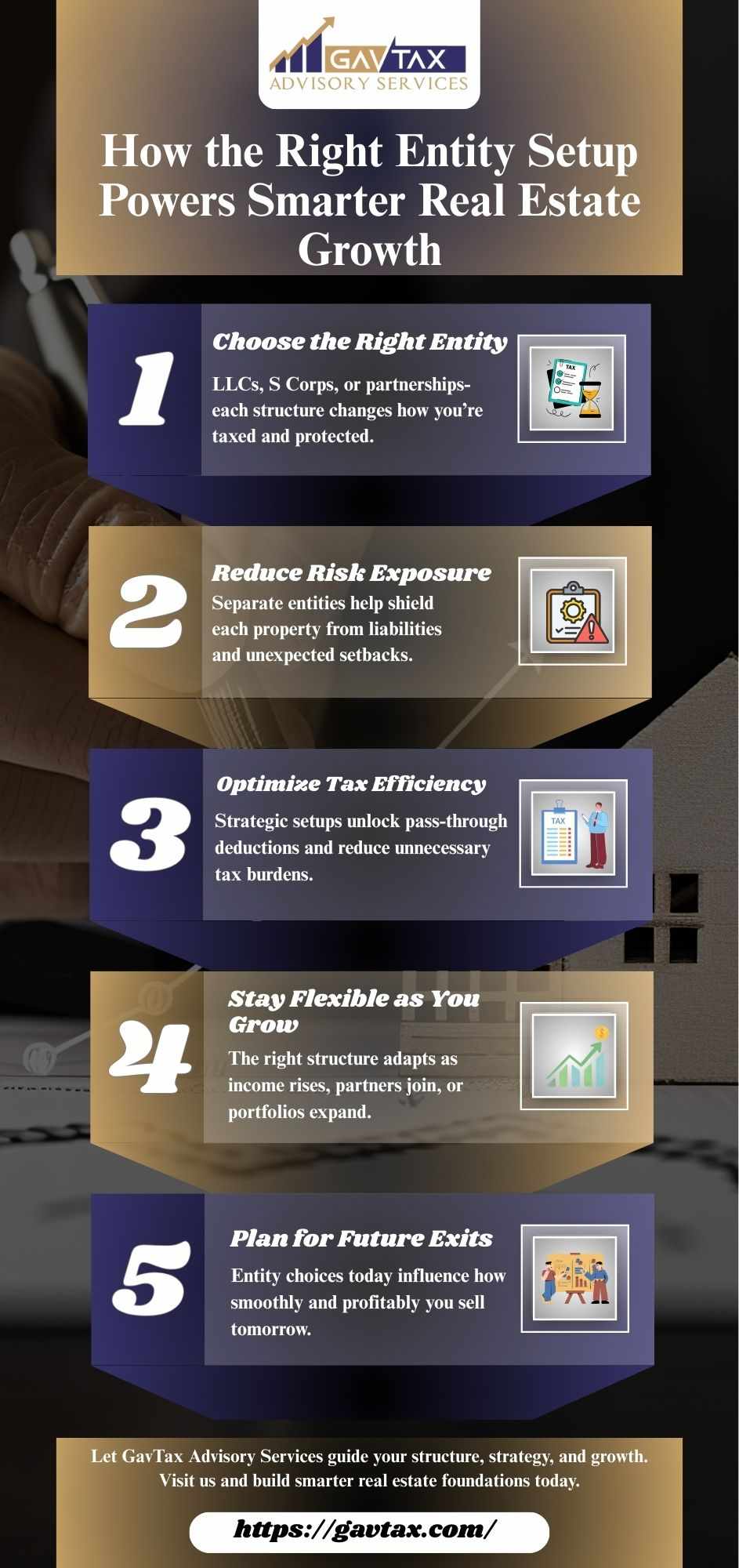

· Planning Ahead: They build strategies around business setups like LLCs, which shield your personal finances and streamline operations.

· Handling Filings: From individual forms to partnership reports, they get it all done right, while watching out for rules on passive losses.

· Maximizing Deductions: They flag write-offs for upkeep or green upgrades, turning routine costs into real tax relief.

By focusing on basics like tracking your property's cost basis from the start, they lay the groundwork to avoid headaches in future deals or audits.

Everyday Tax Traps and Smart Ways Around Them

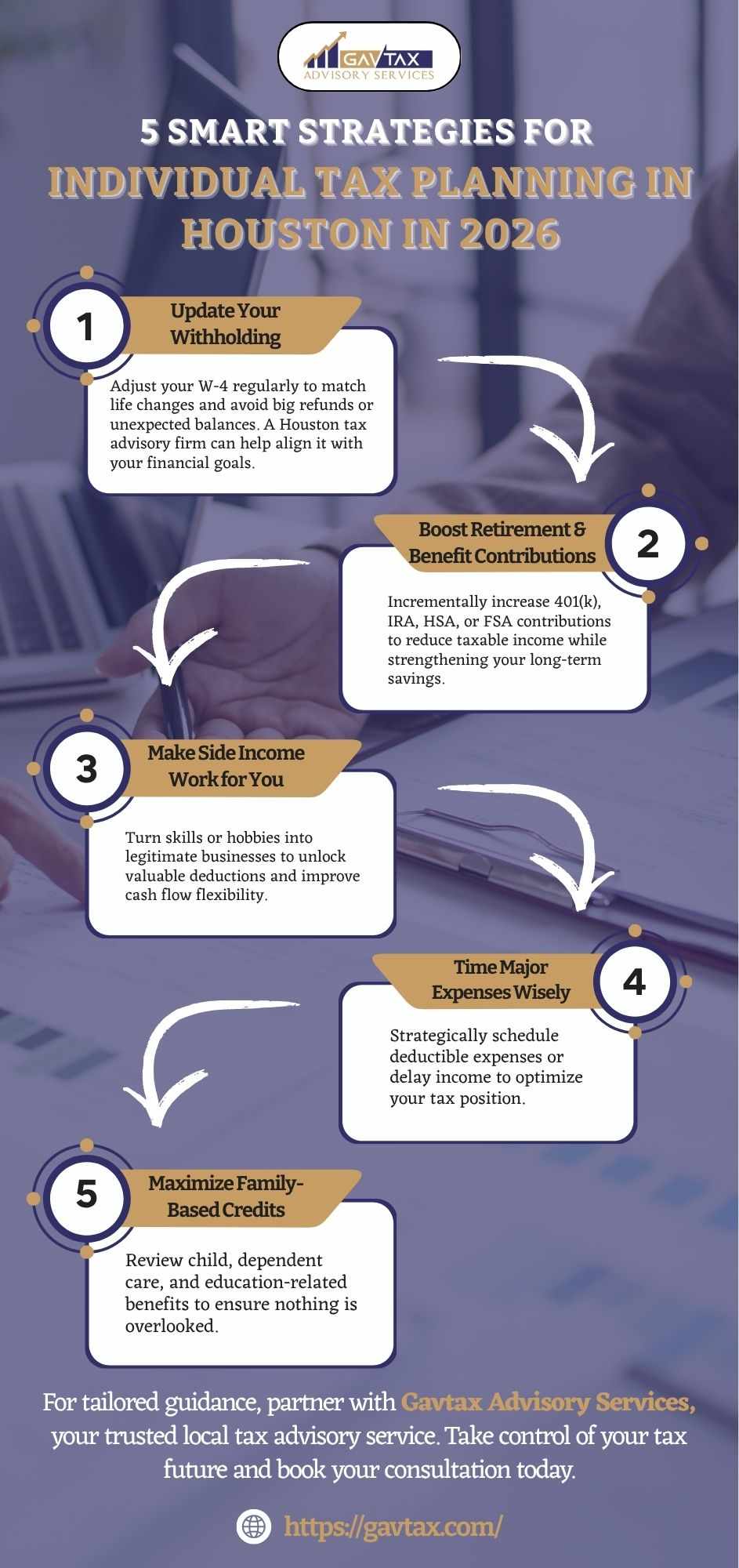

Property owners run into the same snags time and again, but they're easier to dodge with the right know-how. Take the mix-up between repairs and upgrades: quick fixes that keep things running get deducted right away, but bigger changes that boost value spread out over years. Getting this wrong can mean rejected claims or an audit knocking at your door.

Primary home sellers often miss out on capital gains breaks tied to how long you've lived there and owned it. Rental folks might skip helpful rules for deducting expenses, ending up with higher taxes than needed. A reliable tax advisory service steps in with a fresh look at old returns and projections for what's next. They keep up with shifts, like tweaks to mortgage interest limits, so you always have straightforward options.

Why Dallas Real Estate Investors Need a Local CPA

In Dallas's fast-paced housing scene, a CPA for real estate investors Dallas brings that hometown edge, blending state quirks with bigger-picture rules. They guide you through swaps that delay gains or payment plans that ease the hit over time. Some real perks include:

· Sharper tracking of your holdings for smarter oversight.

· Tools to match your spending with market ups and downs.

· Backup during audits to sort things out quickly.

This setup lets you pour energy into expanding your investments instead of wrestling with paperwork.

Closing Out:

Residential real estate keeps evolving as a smart way to grow wealth, and solid tax advice is what holds it all together. Getting it right means steering clear of surprises and setting up for long-term wins.

If you're in Dallas and ready for dependable Residential property tax advisory service, checking in with pros like those at GavTax Advisory Services could be the simple shift you need. Reach out soon-your properties will thank you for the stability.

Frequently Asked Questions:

Q1. How can a Dallas tax consultant prevent property mistakes?

They catch errors early and guide you through accurate Dallas tax filings.

Q2. What tax tasks does a residential consultant handle?

They manage filings, deductions, depreciation, and long-term tax planning.

Q3. Why hire a local CPA for Dallas real estate tax?

A local CPA knows Dallas rules, cutting risks and maximizing property savings.

Write a comment ...