When tax season comes around, many people want to get the best possible return but aren’t sure how to make it happen. The truth is, maximizing your tax refund depends a lot on careful planning, good record keeping, and getting the right advice. Working with professional CPA firms in Houston, TX can be the key to unlocking savings you might miss on your own.

This article explains practical ways CPA firms help improve your tax situation, reduce your liabilities, and make sure you stay on the right side of the law.

Why Hiring a CPA Firm Matters for Your Taxes?

Many people try to handle their taxes alone or with minimal help, but this often leads to missed opportunities. The tax system is complex and always changing. Without expert advice, it is easy to overlook deductions and credits that could save you money.

CPA firms bring several advantages, such as:

Updated knowledge

CPAs stay current with all tax laws so your filings meet all legal requirements.

Year-round tax planning

They don’t only prepare returns but work on strategies throughout the year to reduce taxes owed.

Audit support

If the IRS questions your return, a CPA can represent you and offer expert guidance.

Time saved

Letting professionals handle your taxes frees you from the stress and the paperwork.

A competent CPA firm sees your full financial picture, including income, investments, and business activities, to tailor tax strategies that work best for you.

Organize Your Records Early

Important records to track include:

Business expenses if you are self-employed or own a small business

Real estate costs if you are a property owner or investor

Itemized deductions such as medical bills or charitable gifts

Contributions to retirement accounts or health savings funds

When everything is ready and clear, CPAs can find all valid deductions to strengthen your return.

Take Advantage of Tax Planning

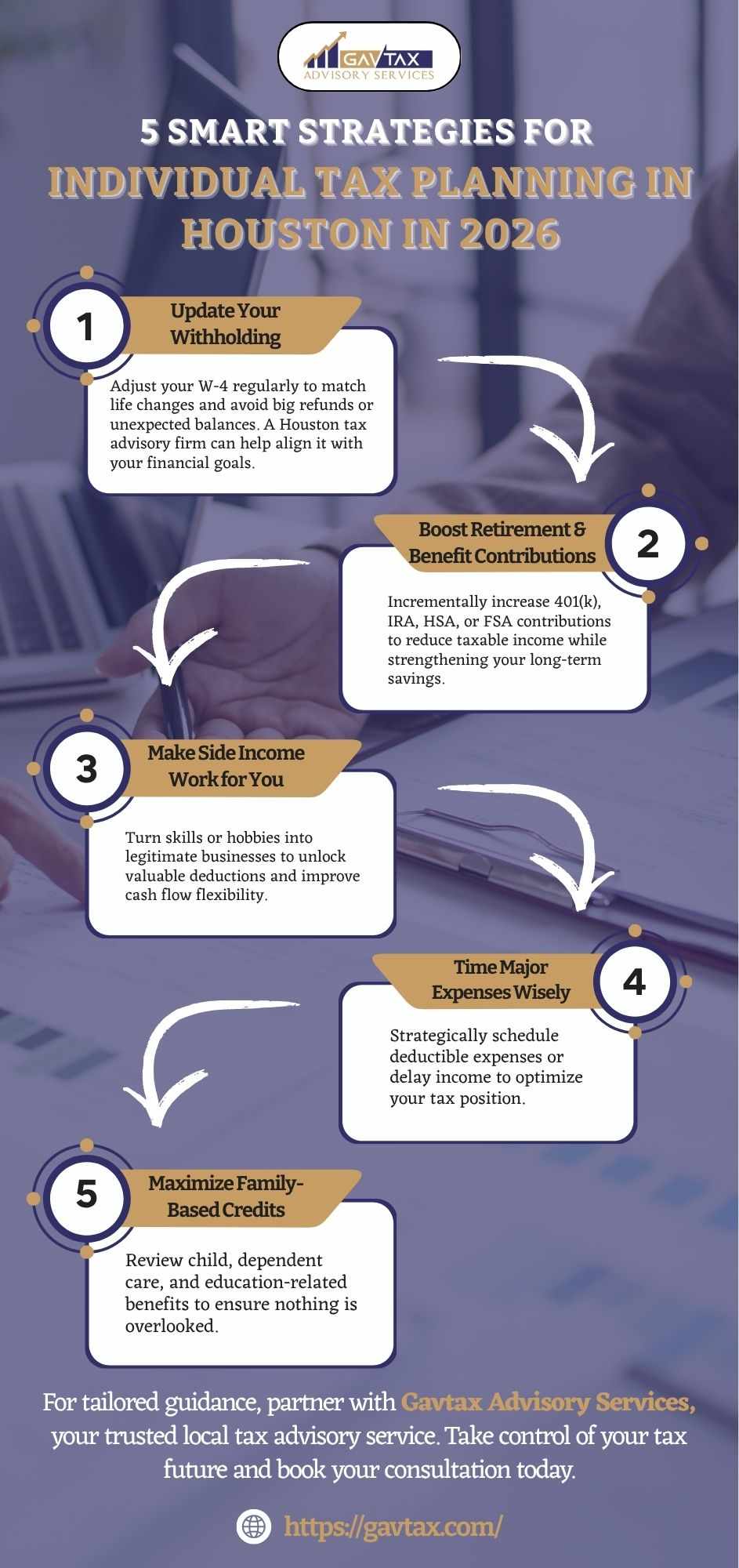

Next, good planning changes the way you approach taxes completely. Many taxpayers only think about taxes near the April deadline, but the best savings come from planning throughout the year.

CPA firms provide tax planning advice that may include:

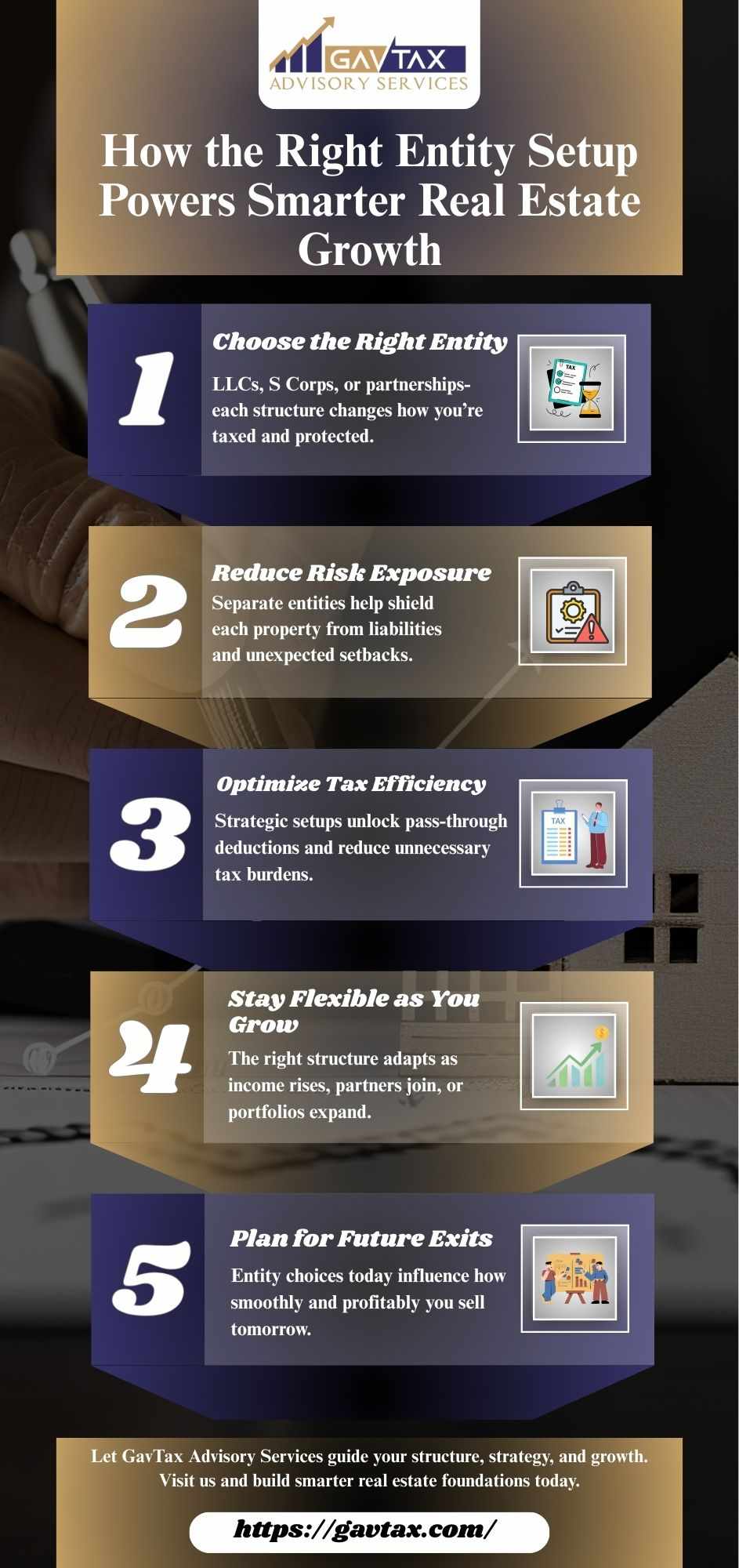

Choosing the right business entity for tax benefits and asset protection

Timing your income and expenses to lower taxable income in key years

Making maximum contributions to retirement plans for tax deductions

Planning your sales of investments in ways that minimize capital gains taxes

This ongoing attention to your finances helps reduce surprises and produces better overall results.

Use Every Credit and Deduction

Tax credits and deductions cut your tax bill but often require detailed knowledge to apply correctly. Many taxpayers miss these savings because credits and deductions are overlooked or not understood.

Experts track available credits closely including:

Education and training credits

Energy-efficient home improvements

Child and dependent care credits

Business incentives offered by government programs

CPAs also prepare necessary documentation to support claims, reducing the possibility of costly audits.

Shaking Hands with the Right CPA Firm in Houston

Not all CPA firms offer the same service or value. Consider these when selecting your tax advisor:

Experience with your financial situation, especially real estate or small business

Clear, fair pricing based on your specific needs

Strong client recommendations showing attention to detail

Ability to provide help year-round, not just during tax season

Use of safe, modern tools for bookkeeping and filing

Searching for the best tax expert near me should always include a discussion about your personal tax challenges. A good CPA firm listens and creates solutions that suit your goals.

Long-term Benefits of Professional Tax Services

Every year without professional tax planning is potentially lost savings. Working with a CPA firm turns tax preparation into a tool for improving your cash flow, protecting your assets, and securing a stronger financial future.

You also gain peace of mind knowing your returns are accurate and compliant. Transparent reporting makes it easier to build trust with lenders and investors.

Final Words

To get the most from your tax return in Houston, TX, organize your documents early, engage in year-round tax planning, and choose a skilled CPA firm in Houston, TX like GavTax. Their expertise helps unlock savings, reduce errors, and keep your finances on track.

Partnering with Gavtax can change taxes from a yearly headache into a strategic advantage. It is a smart step to improving your financial health for the years ahead.

Write a comment ...