Running a small business often requires shifting between numerous responsibilities, from customer service to sales and financial management. Reports indicate that nearly 60% of small business owners say they do not feel adequately prepared when it comes to bookkeeping and accounting, which often results in costly errors or lost opportunities. Bringing in a small business CPA Houston provides structure, precision, and clarity for entrepreneurs who would rather focus on building their business than navigating financial details.

Local guidance plays a significant role. Working with a CPA based in Houston or a small business bookkeeper Austin means gaining access to professionals familiar with regional regulations and financial practices.

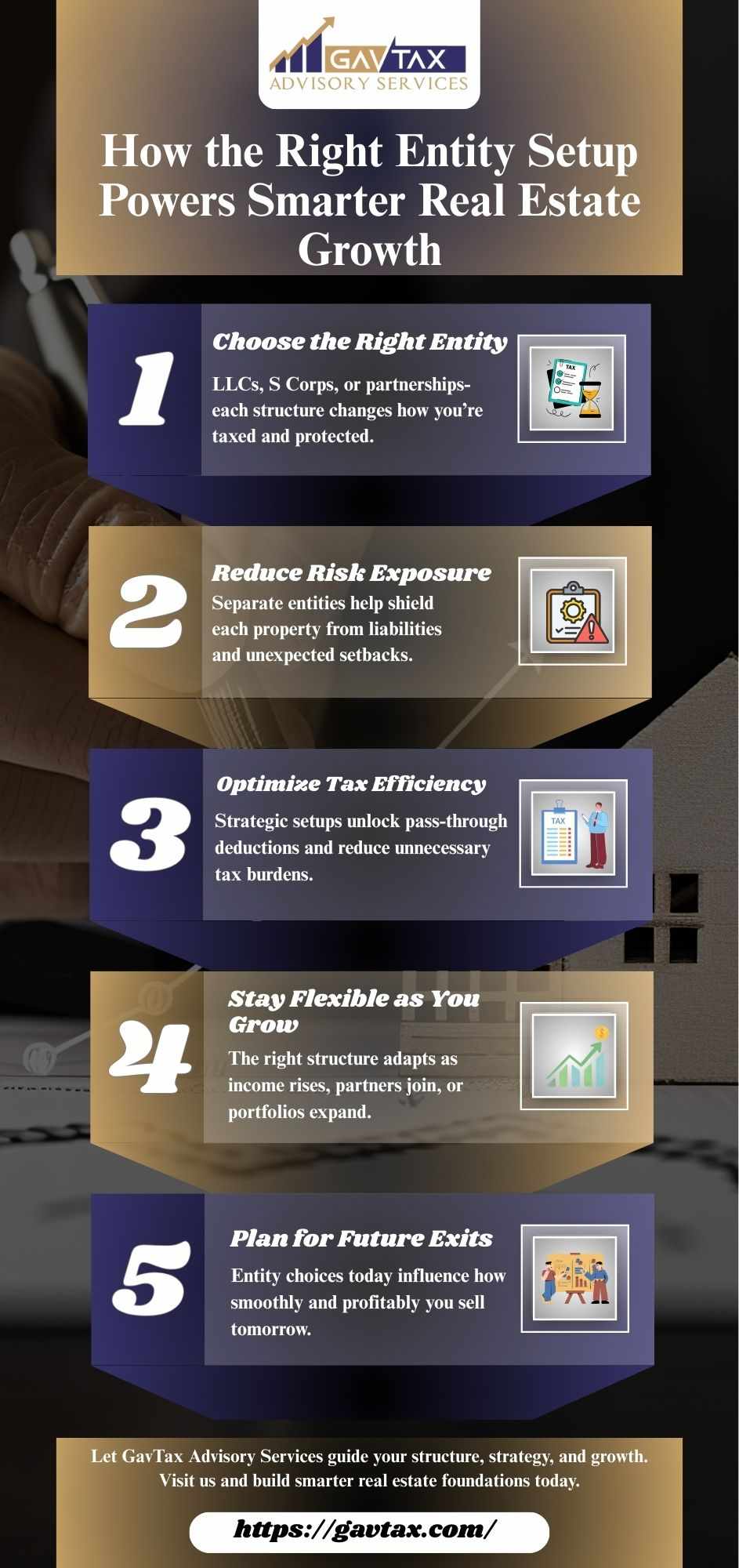

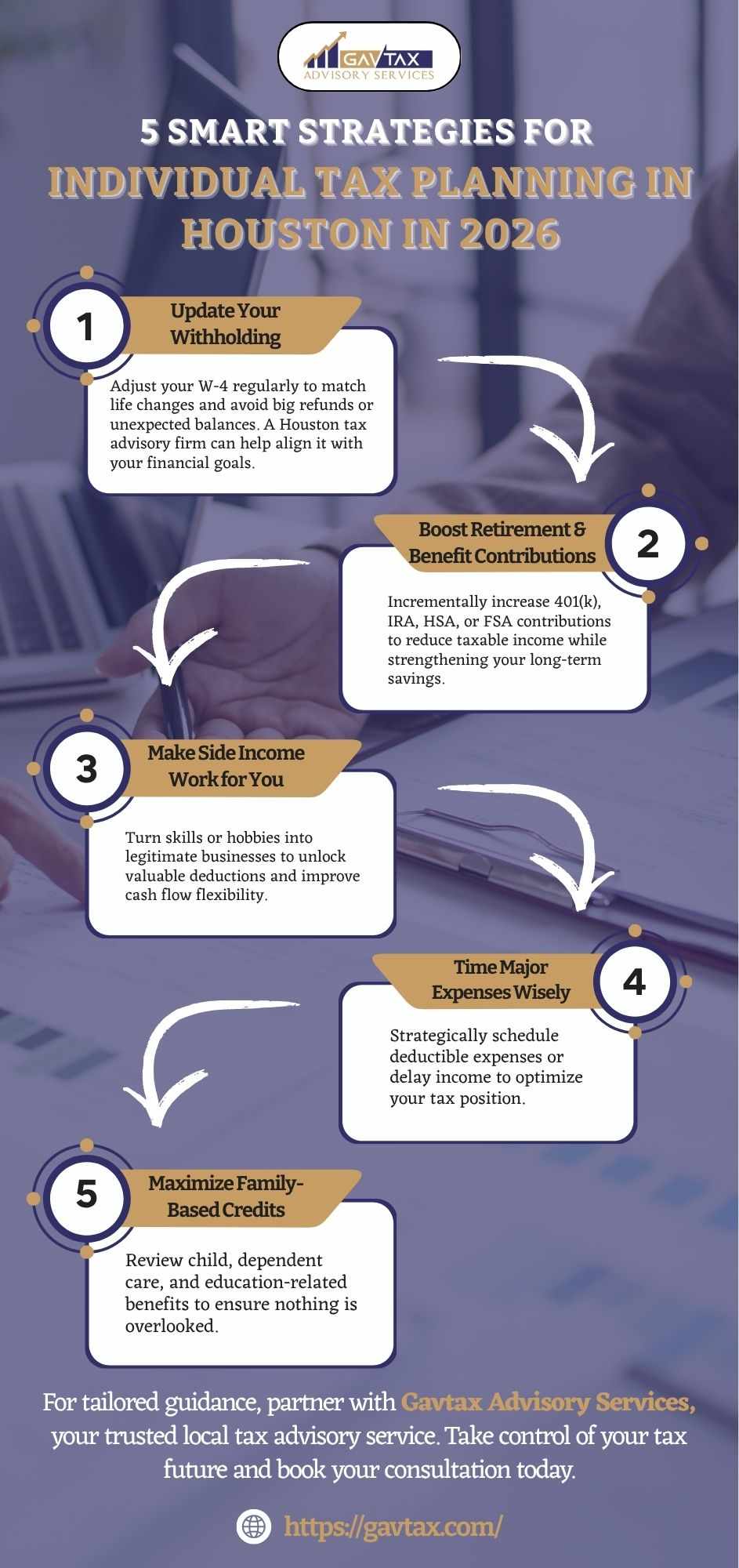

What a Small Business CPA Houston Can Do for You

Streamlined Tax Preparation and Filing

Tax season is one of the most stressful times for small business owners. A small business CPA Houston takes on tax preparation duties while handling all required documents accurately and on schedule. Doing so minimizes risks of penalties and highlights available deductions that lower tax liabilities.

Proactive Financial Strategy for Long-Term Growth

A CPA does more than standard recordkeeping. They create thoughtful financial strategies, project future revenues, and build practical growth models. These plans provide business leaders with the clarity needed to make informed choices about expansion and sustainability.

Compliance with State and Local Houston Regulations

Every region operates under distinct financial rules, and Houston is no exception. Partnering with a CPA who specializes locally reduces the chance of unwanted penalties or delays. Their knowledge of Houston-specific requirements helps keep operations running without unnecessary obstacles.

Top 5 Bookkeeping Benefits with a Small Business CPA Houston

1. Clear and Real-Time Financial Insights

Up to date financial reports make managing expenses and monitoring cash flow far easier. Having reliable visibility means stronger confidence in daily and long-term decision-making.

2. Reduced Risk of Costly Errors

Accounting errors can have serious consequences. Professional support considerably lowers such risks. Research shows that companies working with CPAs are almost 40% less likely to face critical bookkeeping mistakes than those who handle their own records.

3. Better Cash Flow Management

Maintaining good cash flow is critical for sustaining operations. A CPA carefully monitors income and expenditures making it easier to prepare for financial challenges and avoid disruptions.

4. Organized Records for Easier Audits

Should an audit occur, properly documented records make the process smoother. CPAs maintain well-stored and accurate files, saving business owners both stress and valuable time.

5. Time Savings for Busy Entrepreneurs

Delegating bookkeeping provides business owners with more time to focus on areas such as operations and growth. The hours saved often translate directly into improved productivity.

Conclusion: Achieve Financial Clarity with the Right CPA Partner

A small business CPA Houston is not only a tax preparer but also a strategic partner who brings confidence, clarity, and stronger decision-making to small business finances. Working with a small business bookkeeper Austin pairs daily bookkeeping support with regional expertise, while searching for “small business bookkeeping near me” connects owners with trusted financial guidance in their area.

At GavTax Advisory Services, we specialize in helping small business owners gain greater confidence in their finances. Our team also works closely with professionals who are seeking the best CPA for real estate investors near me, delivering tailored solutions that simplify financial management while supporting long-term goals.

Reach out to GavTax today and experience the difference that expert financial guidance can bring to your business.

Write a comment ...