Houston buzzes with energy, featuring a skyline that keeps reaching higher. For small business owners, it's not just about staying afloat; navigating tricky tax rules can catch you off guard. As you develop rental properties in a hot market, unexpected audits or missed deductions can hit hard. That's where a reliable real estate small business CPA in Houston can help, clearing up the confusion and guiding you toward smarter decisions.

In this article, we are going to cover how a real estate accountant, mainly for small businesses, will help you simplify your numbers game. Also, you will know the benefits of hiring an accountant and more. Let's get inside it!

The Tricky Side of Real Estate Taxes for Small Businesses

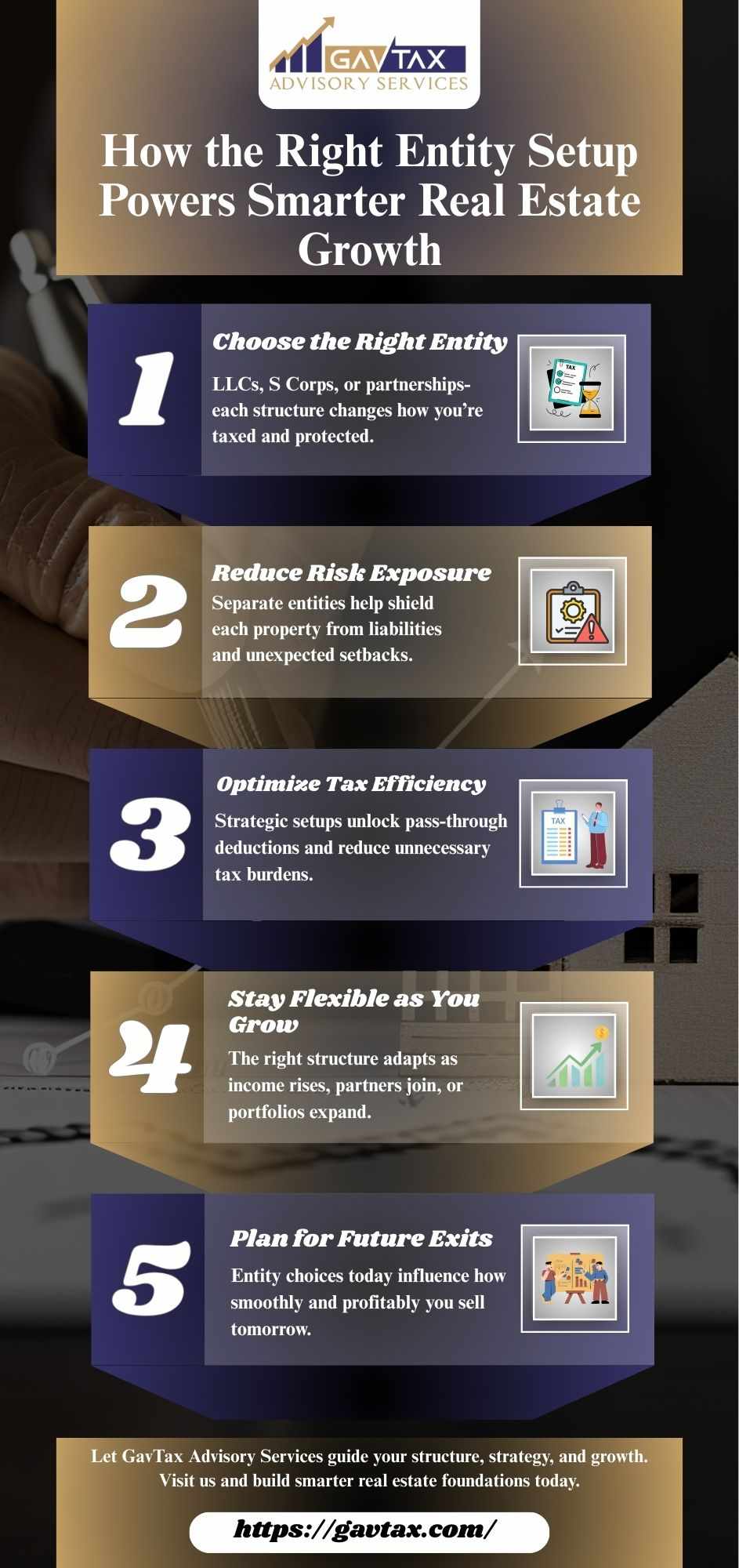

Real estate goes beyond the walls and roofs; it's all about deductions, ways to spread out costs over time, and picking the right setup for your company. Small businesses getting into properties, like steady rentals or quick-turn Airbnb spots, face bigger risks. Get the timing wrong on separating costs or filing as partners, and the IRS might come knocking, eating into what you've earned. A good small business CPA Houston acts like your guide, making sure everything lines up right while spotting chances to save.

What You Gain from Bringing in the Right Expert

Sure, you could go with a basic accountant, but why settle when a specialist can change the game? A sharp top real estate accountant near you digs into the details that turn everyday work into real wins. Here's what stands out:

· Smart Forward Thinking: Regular check-ins catch fresh ideas, like tweaking how profits flow in group deals, so your money stays ready for whatever comes next.

· Strong Defense Against Checks: They keep records tight and stored safely for years, letting you skip the stress of old reviews and push ahead.

· Smoother Day-to-Day: They clean up messy books, turning piles of papers into clear stories that win over banks or team-ups.

· Full-Circle Safety: Picking the best structure-like S-Corps for easy tax flow or teams for split risks, to passing on assets without headaches.

These are real tools, not just talk. Think about pulling back deductions from years ago, fixing old filings for money back that funds your next buy. In Houston, where prices keep rising like the summer heat, that kind of heads-up keeps you ahead.

What Makes Houston's Tax World Different

Our city stands out with its wild mix of trade and growth, tying real estate to big global flows. That means you need help with local twists, like breaks on taxes for bringing old spots back to life or boosts for apartment builds. A tuned-in real estate tax advisor Houston gets these beats, helping your small business fit Texas's easy-doing-business vibe without federal snags. No matter if you're a side-hustle flipper or growing a full rental lineup, quick chats-often set up in a couple of days- break it all down.

Tailored Help for Folks Building Portfolios

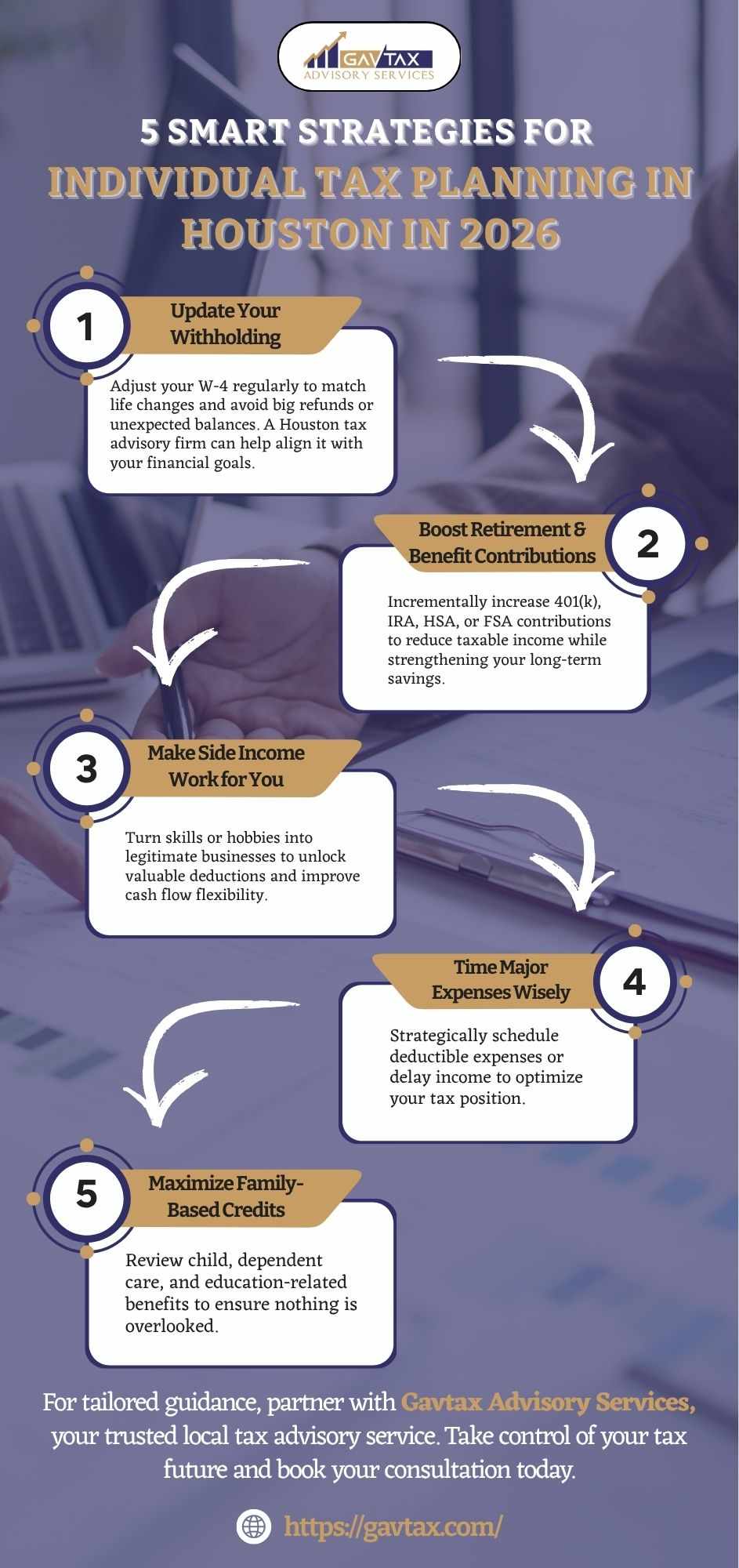

If you're stacking properties, finding the best CPA for real estate investors near you means looking for real know-how in crunching numbers and boosting returns. They break down past trends to predict what's next, suggesting setups that make loans or sales easier. Quick hits on the upsides:

1. Custom Tax Plays: Skip steeper rates with sharp cuts, even if you've been at it a while.

2. Help Anytime: Solid backup all week, no waiting for busy seasons.

3. Straight-Up Trust: Fair advice that clicks, like stories from clients who found extra cash they didn't know was there.

It's not fancy-it's game-changing stuff that flips tax time from drag to boost.

Wrap Up:

Houston keeps growing, and staying sharp on money matters is key to riding that wave. Teaming up with a reliable small business CPA Houston pays off in ways that last. If you're set to shore things up, grab a free chat with a spot like GavTax Advisory Services, and they'll light the way.

Write a comment ...